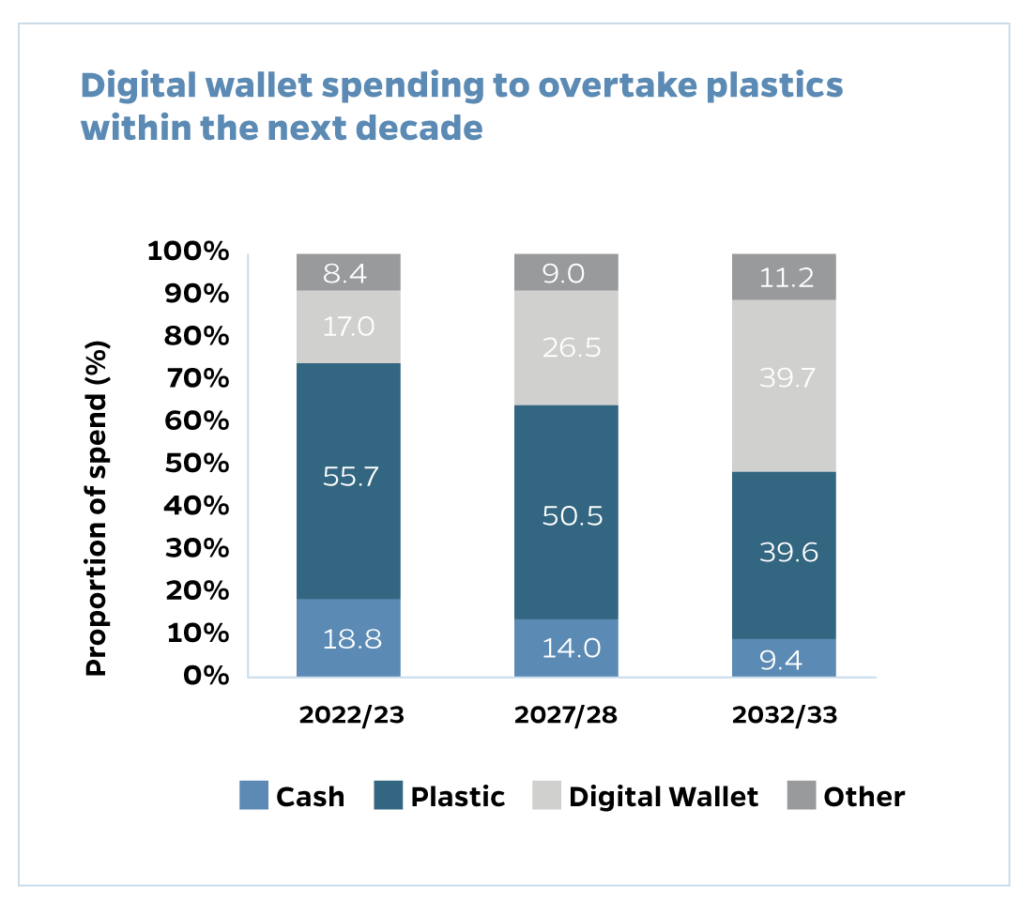

LONDON, 14 SEPTEMBER 2023: New research by FreedomPay and Retail Economics shows that the UK is on the brink of a digital payments transformation, with digital wallet purchases set to surpass card transactions within ten years.

Currently, around a fifth (17.0%) of retail, leisure and hospitality spending is made through digital wallets; compared to over half (55.7%) by plastic, and a fifth (18.8%) for cash. This is set to increase to £127.7bn in 2027/28 (£72.5bn currently). By 2033, the share of digital wallet payments will likely more than double to 39.7% to £210bn.

In the next five years, the value of digital wallet use is set to surge by 76.3% – well ahead of other payment methods including transactions through loyalty points and Buy Now Pay Later (BNPL) services, while more traditional payment methods of cash and card are predicted to decline.

Figure [1]: Digital wallet spending to overtake plastics within the next decade. Source: FreedomPay and Retail Economics.

UK shoppers seek maximum convenience through payments as they embrace cross-channel shopping and personalisation. In the next five years, the emerging connected shopper will expect seamless omnichannel experiences and place increasing value on integrated loyalty schemes and personalised offers – with almost a third (31.7%) wanting both features in the future – as well as BNPL options.

Figure [2]: The value of digital wallets is evolving at pace over time. Source: FreedomPay and Retail Economics.

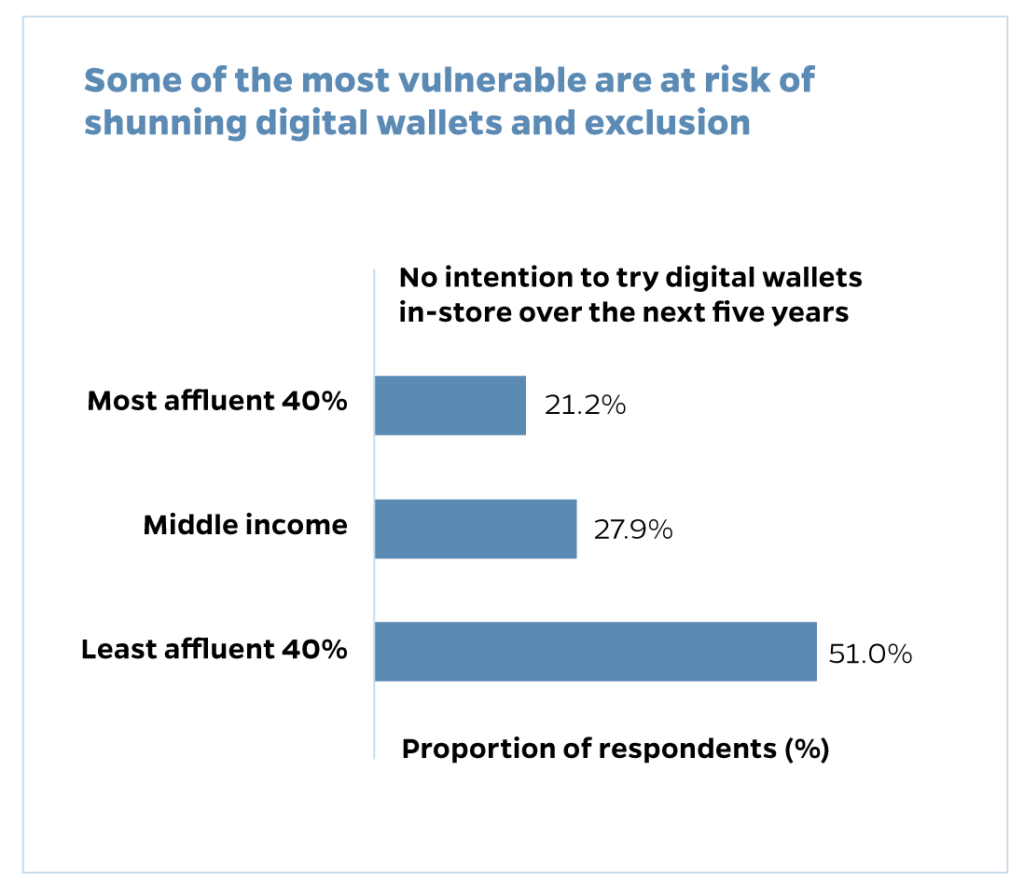

The research shows that the wealthiest 20% of shoppers spend almost five times the amount by value compared with the poorest group, which is currently driving the rapid growth in digital wallet transactions. Two-thirds (66.4%) of affluent under 35s have used a digital wallet in a physical environment in the last 12 months. In this group, digital wallets have already overtaken cash.

However, digital wallets risk excluding some of the most vulnerable. One in six respondents stated they have no intentions of using digital wallets over the next five years – half of these customers are in the bottom two affluence groups, aged over 55, with a quarter having no (or unreliable) mobile data access when shopping.

Figure [3]: Some of the most vulnerable are at risk of shunning digital wallets and exclusion. Source: FreedomPay and Retail Economics.

FreedomPay President, Chris Kronenthal, says: “This research is a clear indication that the world of payments is changing rapidly, and the merchant needs to adapt to meet the needs of the evolving payment tech landscape.

“It’s no surprise that physical forms of payments such as cash and plastic will be surpassed by digital wallets in the years to come and it’s an imperative that businesses re-evaluate their commerce capabilities.”

Retail Economics Chief Executive, Richard Lim, says: “Digital wallets are poised to become the primary mode of payments, eclipsing the use of physical cards and cash. Shoppers love the convenience they offer, helping to provide a more seamless journey that blends physical and digital together while incorporating the benefits of more personalised offers and loyalty schemes.

“While younger, more affluent shoppers have been at the forefront of this transformation, the industry must ensure that the benefits of digital wallets are accessible to all, irrespective of age or financial status. Fundamental to this is building trust in digital wallets and bridging knowledge gaps to avoid leaving vulnerable customers behind.”

Download From Plastic to Pixels Here

For more information, contact:

H+K for FreedomPay

[email protected]

NOTES TO EDITORS

Research methodology

In this research digital wallet were defined as “financial technology innovation, providing cashless experiences by storing payment, loyalty and other details on a smartphone app or wearable device for online and offline transactions.” Examples include payments through mobile apps such as Google Pay, Apple Pay, PayPal, Tesco Clubcard app via smartphone, or wearable devices (e.g. smartwatch).

Modelling and analysis undertaken by Retail Economics. It uses a nationally representative survey across 2,000 shoppers undertaken in August 2023 and draws on third-party sources including national statistics.

About FreedomPay

FreedomPay’s Next Level Commerce™ platform transforms existing payment systems and processes from legacy to leading edge and enables merchants to unleash the power of pay. As the premier choice for many of the largest companies across the globe in retail, hospitality, lodging, gaming, sports and entertainment, foodservice, education, healthcare and financial services, FreedomPay’s technology has been purposely built to deliver rock solid performance in the highly complex environment of global commerce.

The company maintains a world-class security environment and was first to earn the coveted validation by the PCI Security Standards Council against Point-to-Point Encryption (P2PE/EMV) standard in North America. FreedomPay’s robust solutions across payments, security, identity, and data analytics are available in-store, online and on-mobile and are supported by rapid API adoption. The award winning FreedomPay Commerce Platform operates on a single, unified technology stack across multiple continents allowing enterprises to deliver an innovative Next Level experience on a global scale. www.freedompay.com

About Retail Economics

Retail Economics is an independent economics research consultancy focused on the retail industry. We provide independent thought leadership on major economic and retail trends and analyse their impact on the industry. Retail Economics provides proprietary data on sector growth, behavioural trends, channel performance and forecasts.

Find out more at www.retaileconomics.co.uk

Contributors – Nicholas Found, Richard Lim, Yaamir Badhe